Crafting energy investment portfolios from off-the-run alternative investment strategies

Innovative portfolio design

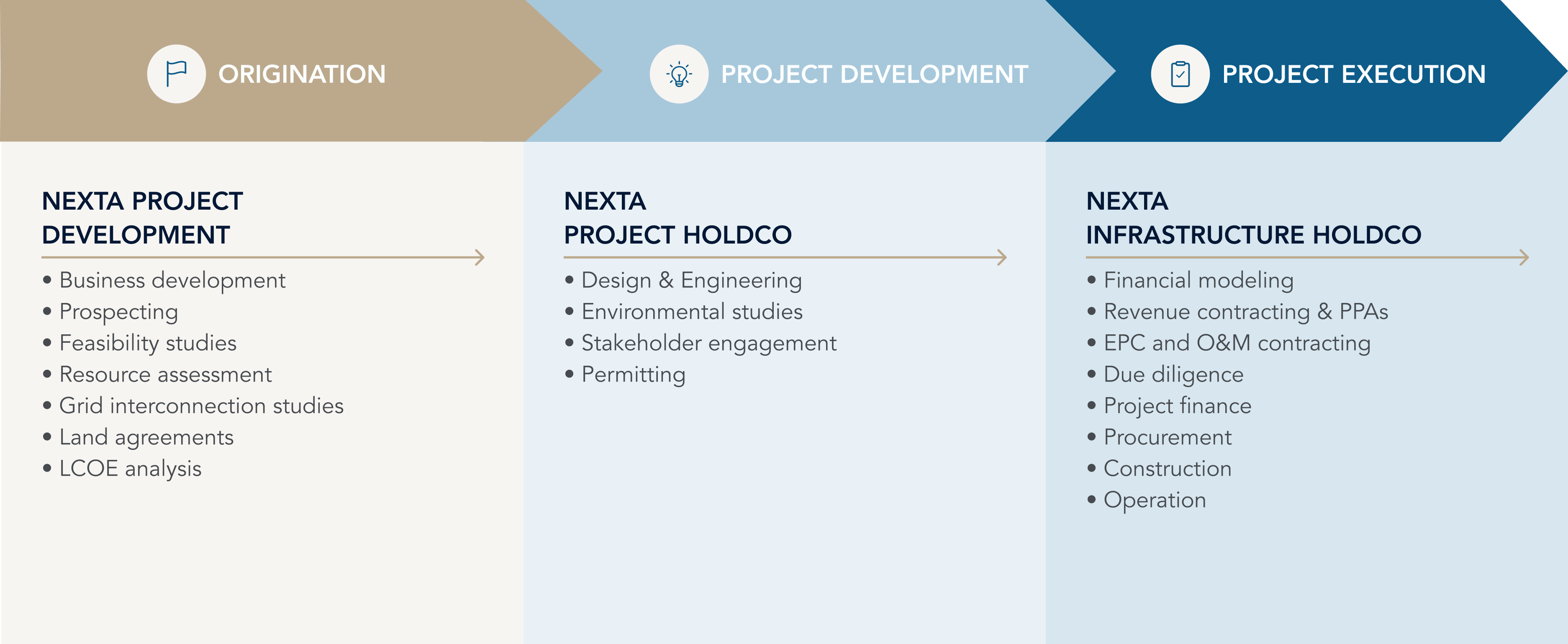

Crafting a dynamic approach from concept to operation

Explore our sustainable energy portfolio design, delivering superior returns in a transitioning economy, and our unique approach to energy development, blending project competencies with investment execution skills.

Value Creation

As real asset investors, we create value by generating consistent, sustainable cash flows and making operational improvements. The high-quality, long-life nature of our asset base tends to provide insulation from the extremes of the market cycles, with the ability to provide strong returns across all market conditions.

Dynamic Approach

The relationship between project development competencies and investment execution skills uniquely positions us to deliver a dynamic, customized approach to energy generation that is responsive to rapidly changing energy markets and financial trends.

Revenue Proposition

The core objective of the origination and development platform is to create a revenue proposition that allows for a project to be constructed with adequate returns, create a significant potential for value creation, and provide reliable and flexible renewable energy. Projects are designed and built for a seamless transition from development to operations.

Sustainable Returns

We generate superior, risk-adjusted investment returns from opportunities arising from the transition to a more sustainable economy with a medium to long-term horizon. Our goal is to target both financial and non-financial returns.

Operational excellence throughout the entire value chain

Committed to source renewable, reliable and cost-effective power and gas assets

The group has demonstrated a unique capability to consistently identify and source opportunities through robust criteria and disciplined procedures. Sector focused expert team with full-range capabilities to manage and execute projects enabled the group to rapidly build-out a proprietary pipeline of diversified and de-risked projects. This creates a revenue proposition that allows for a project to be constructed with adequate returns, generating significant value potential.

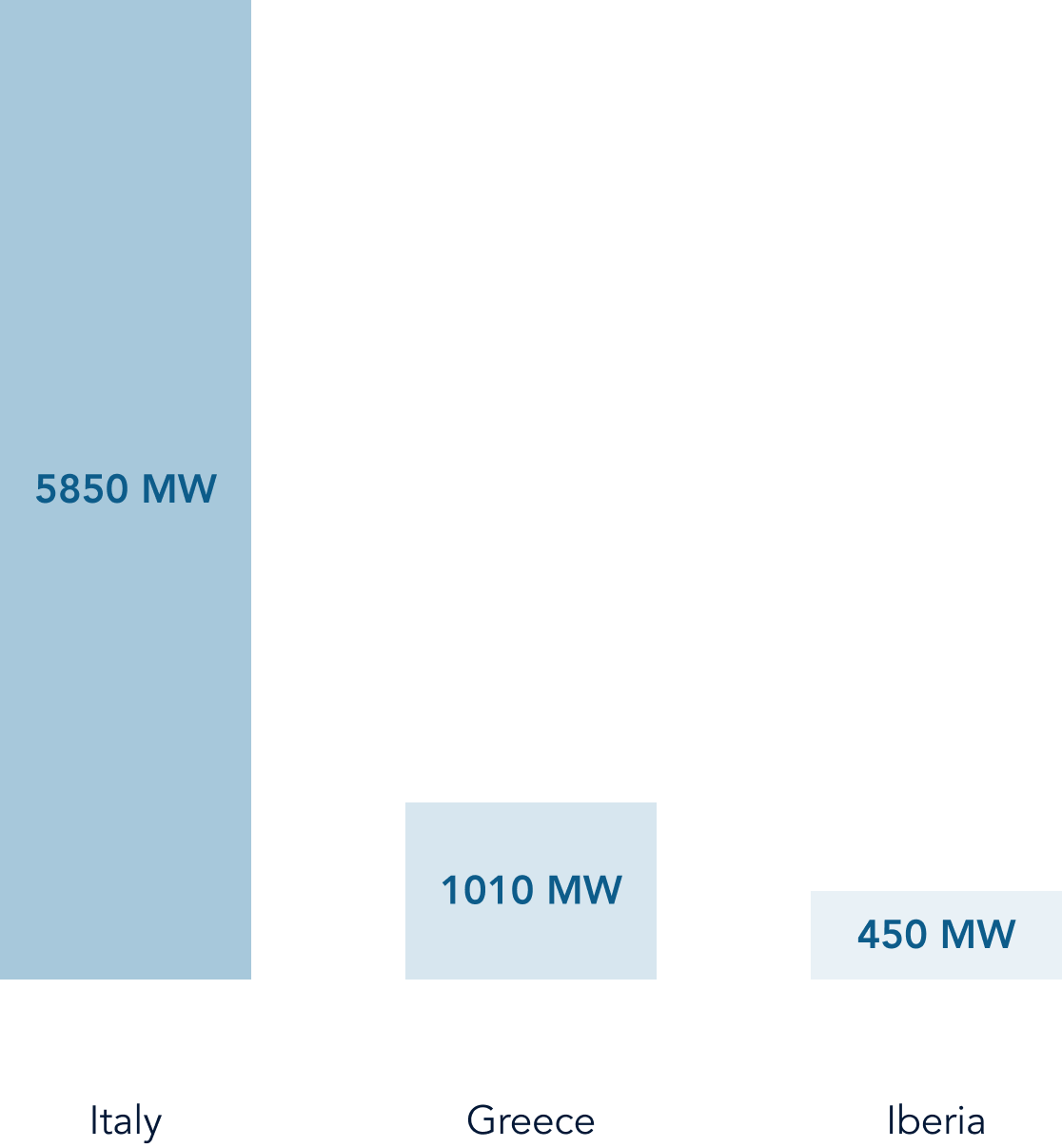

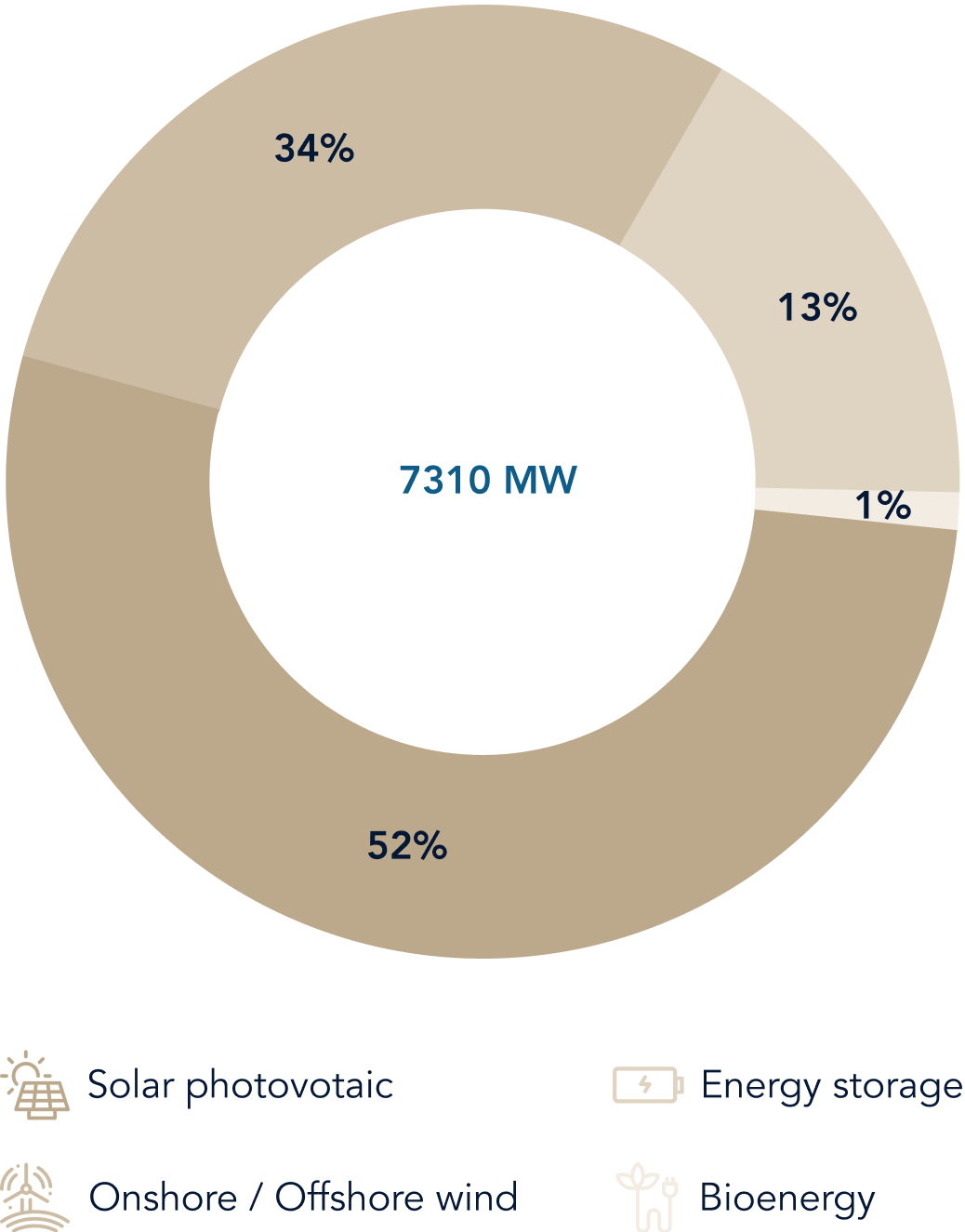

Assets

Breakdown by country

Breakdown by technology

Investment management

A diversified portfolio of infrastructure investments

Nexta Investment Management (NIM) is the emerging alternative investment advisor, part of Nexta Capital Partners, that provides asset management to institutional investors on alternative assets with a primary focus on renewable energy sources. NIM launched Nexta Renewable Fund S.C.A. SICAV-RAIF (NRF), a closed-ended investment vehicle domiciled in Luxembourg, classified as Article 9 as defined in the EU Sustainable Financial Disclosure

Regulation, investing in a seed energy transition portfolio targeting sustainability and non-financial attributes. NRF designs sustainable infrastructure portfolios by securing captive interest in the group’s proprietary portfolio with the aim of implementing uncorrelated investment strategies focused on delivering value to the biosphere and generating attractive returns.

Visit www.nexta-im.com

Nexta Investment Management (NIM) is the emerging alternative investment advisor, part of Nexta Capital Partners, that provides asset management to institutional investors on alternative assets with a primary focus on renewable energy sources. NIM launched Nexta Renewable Fund S.C.A. SICAV-RAIF (NRF), a closed-ended investment vehicle domiciled in Luxembourg, classified as Article 9 as defined in the EU Sustainable Financial Disclosure Regulation, investing in a seed energy transition portfolio targeting sustainability and non-financial attributes. NRF designs sustainable infrastructure portfolios by securing captive interest in the group’s proprietary portfolio with the aim of implementing uncorrelated investment strategies focused on delivering value to the biosphere and generating attractive returns.

Visit www.nexta-im.com

Visit www.nexta-im.com